IMO 2020[i] sulfur regulations are about to force an unprecedented reduction in the sulfur content of fuels burned on the open ocean, and this will cause the differential between oil prices and bunker prices to rise dramatically over the second half of 2019 and into 2020. In anticipation of rising oil prices and rising fuel price differentials, carriers have begun to introduce new bunker surcharge formulas.

BCOs are challenged by information asymmetries

Ocean carriers know how much fuel they will consume per container slot on each string that they operate. Moreover, they know how this figure will change as they take delivery of new vessels and upsize their strings.

Most BCOs have relatively little insight into these factors and cannot judge whether the revised surcharges are fair reflections of carrier fuel consumption and expenditures.

Carriers are aware of the information asymmetry, and the impending IMO 2020 sulfur regulations are providing carriers with both motive and opportunity to leverage the knowledge gap going into the upcoming contract negotiation season.

Carriers have presented these surcharges as non-negotiable. The reality is that everything is negotiable, and even if a BCO agrees to a surcharge formula, they can negotiate the base rate in order to get to an all-in price that makes sense for their supply chain.

How can Mercator International help?

Mercator’s consultants have decades of experience in carrier network design, vessel deployment planning and fleet forecasting, and we can leverage our proprietary voyage cost models to help close the information gap so that BCOs can negotiate their service contracts with greater confidence.

Many of the major ocean carriers have already published new bunker surcharge formulas, and most of these have already gone into effect. They all share a basic formula in which a benchmark fuel price is multiplied by round trip fuel consumption to determine total fuel cost, and this fuel cost is then split among the loaded containers (with headhaul volumes weighted more heavily than backhaul volumes) to derive a per-TEU container surcharge.

Given the similarities of the formulas, one might expect bunker surcharges to be similar across all carriers competing in a trade lane, but the reality is the amount of bunker consumed per container can vary by more than 30% even on a relatively short-distance service like the Transpacific, and fuel accounts for around half of a carrier’s operating costs.

Mercator can estimate what a reasonable bunker surcharge should be by trade lane and carrier. Furthermore, we can estimate how these costs are likely to evolve over the course of the year as carriers upsize their vessels.

We can also provide critical insight into how oil prices and fuel prices are likely to change over the coming contract period, so that abstract bunker surcharge algorithms can be extrapolated into real dollar terms.

Moreover, Mercator has a proven track record in accurately forecasting container volumes by trade lane, and investors have relied on our forecasts when conducting transportation infrastructure transactions that are valued in the billions of dollars. Mercator has extensive knowledge of the number and size of ships that each carrier has on order, and our decades of experience in network planning enables us to anticipate how carriers are likely to deploy these vessels.

Thus, with trusted forecasts of supply and demand, Mercator can provide BCOs with a broader and more accurate perspective and help them understand how capacity utilization is likely to evolve on each trade lane, which is critical to evaluating the strength of each carrier’s negotiating position.

More so than in most years, contract negotiations in 2019 are critical because ocean carriers will be looking to establish new bunker surcharge norms that will carry over into coming years.

If you would like to learn more about how Mercator can help you negotiate a fair bunker surcharge, please contact Derik Andreoli at 425-803-9876 or dandreoli@mercatorintl.com.

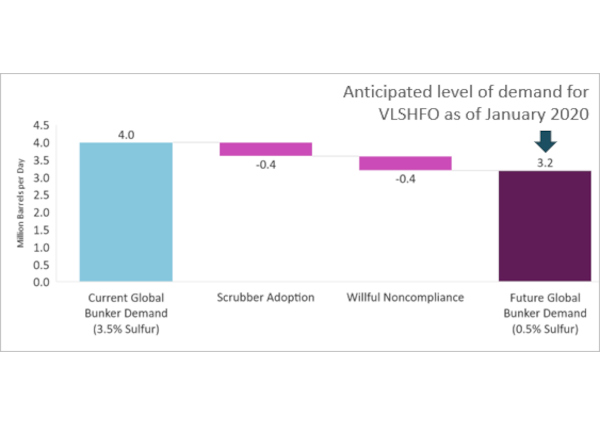

[i] IMO 2020 refers to the final phase-in period for sulfur emissions regulations as stipulated by the International Maritime Organization mandating that on January 1, 2020, the maximum amount of sulfur allowed in ship fuels is to be reduced from 3.5% to 0.5% by mass. Alternatively, any ship that has an exhaust scrubber installed will be granted an exemption allowing its operator to continue to burn high sulfur fuel oil (HSFO) when steaming in open waters. Mercator estimates that ships with exhaust scrubbers will be responsible for less than 10% of global bunker consumption, which currently stands at approximately 4 million barrels per day (bpd). An additional 10% of current HSFO demand will continue to be consumed by operators seeking to cheat the system and by operators that are granted fuel non-availability exemptions. An inconsequential amount of fuel demand will be met through growth in alternative fuel-powered ships (primarily LNG powered vessels).

Consequently, around 3.2 million bpd of HSFO will need to be desulfured to meet IMO 2020 regulations. A reduction of such magnitude over such a compressed period is unprecedented, and the impacts will ripple through petroleum markets. Refineries will need to blend a significant volume of low sulfur distillates (read: diesel) with higher sulfur residual fuel streams in order to achieve the 3.0% reduction in sulfur content.

Demand for diesel and other middle distillates is expected to increase by between one and two million bpd. As a point of reference, around four million bpd of distillates are consumed in the US, so the increase in demand will be comparable to increasing the current US demand level by 25% to 50%. IMO 2020 will impact fuel prices across all modes.