Value is a function of volumes, rates, costs, investment, and risk. Mercator International offers a comprehensive suite of professional services oriented towards helping stakeholders navigate uncertainty while making strategic decisions regarding these value levers.

Strategic Planning

Whether your company is a large enterprise with a sophisticated strategic planning process, or a small-business exploring formal strategic planning for the first time, Mercator can help. Mercator has developed strategic plans for some of the largest transport entities in the world, but has also helped small businesses refine their strategic plans.

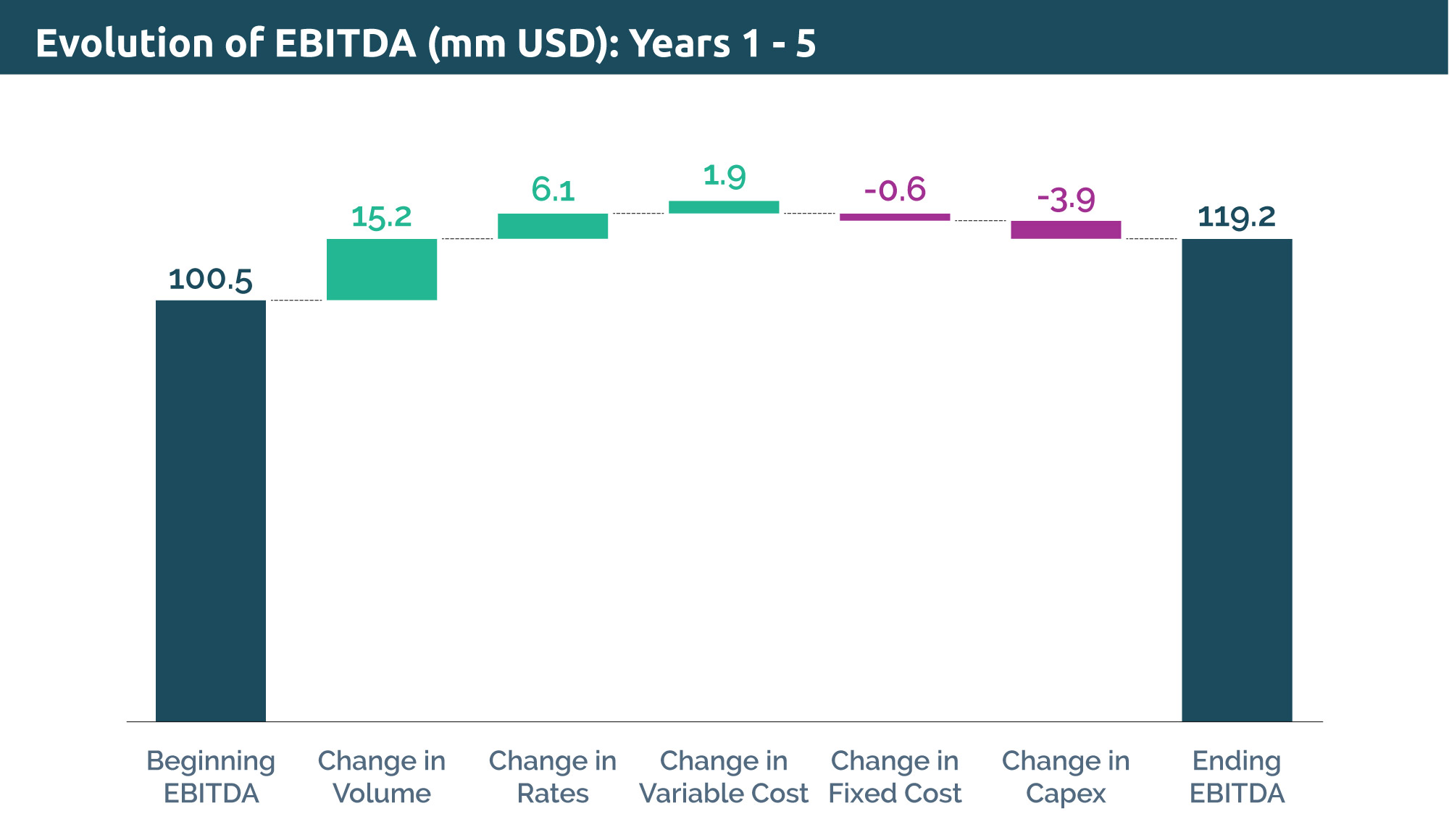

Business Valuation

Whether you are trying to understand what your business is worth, or are evaluating the financial implications of a specific strategic or tactical initiative, Mercator can assist you. Our consultants have bought and sold businesses/business units, developed comprehensive financial valuation models, and worked directly for both financial and strategic investors in the infrastructure and transport sector.

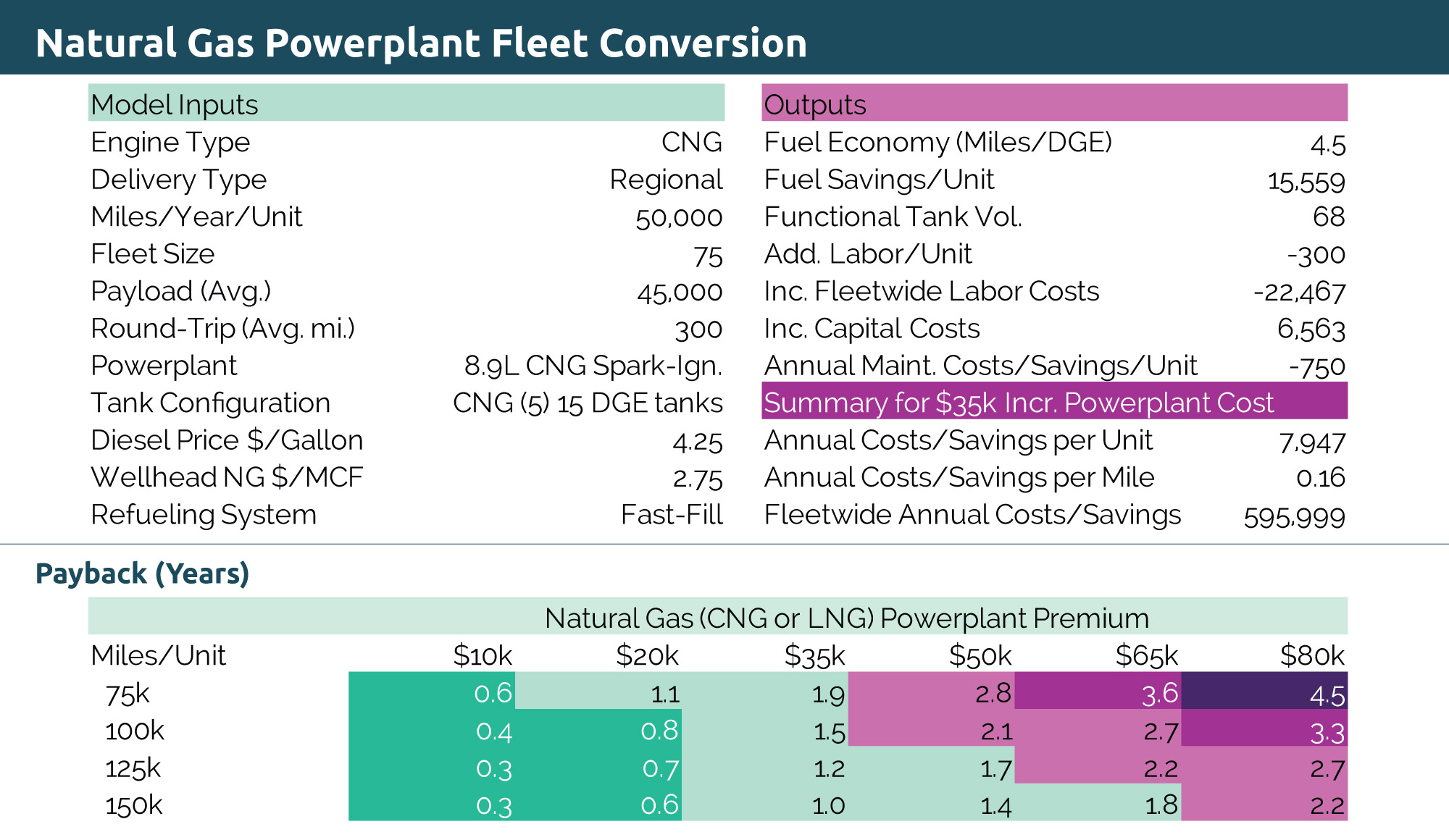

Capital Investment Analysis

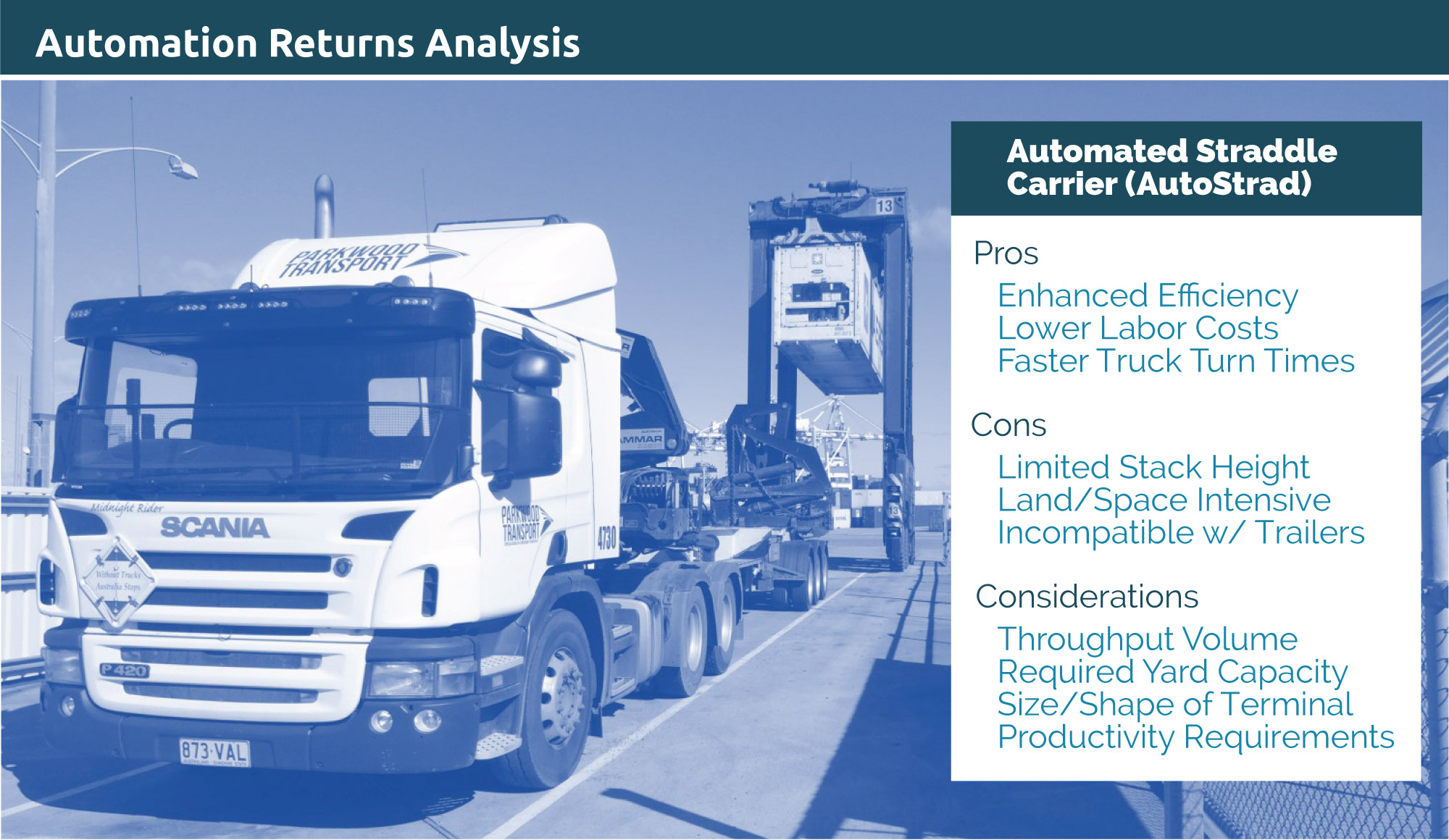

Is your firm considering a major investment in a new facility, equipment, or technology? The transport sector is both complex and capital intensive, and Mercator’s consultants have been involved in evaluating the merits of major investments in new ships, terminals, cranes, warehouses, and equipment fleets, among others. Mercator can help you navigate the strategic and financial elements inherent in making large-scale investment decisions.

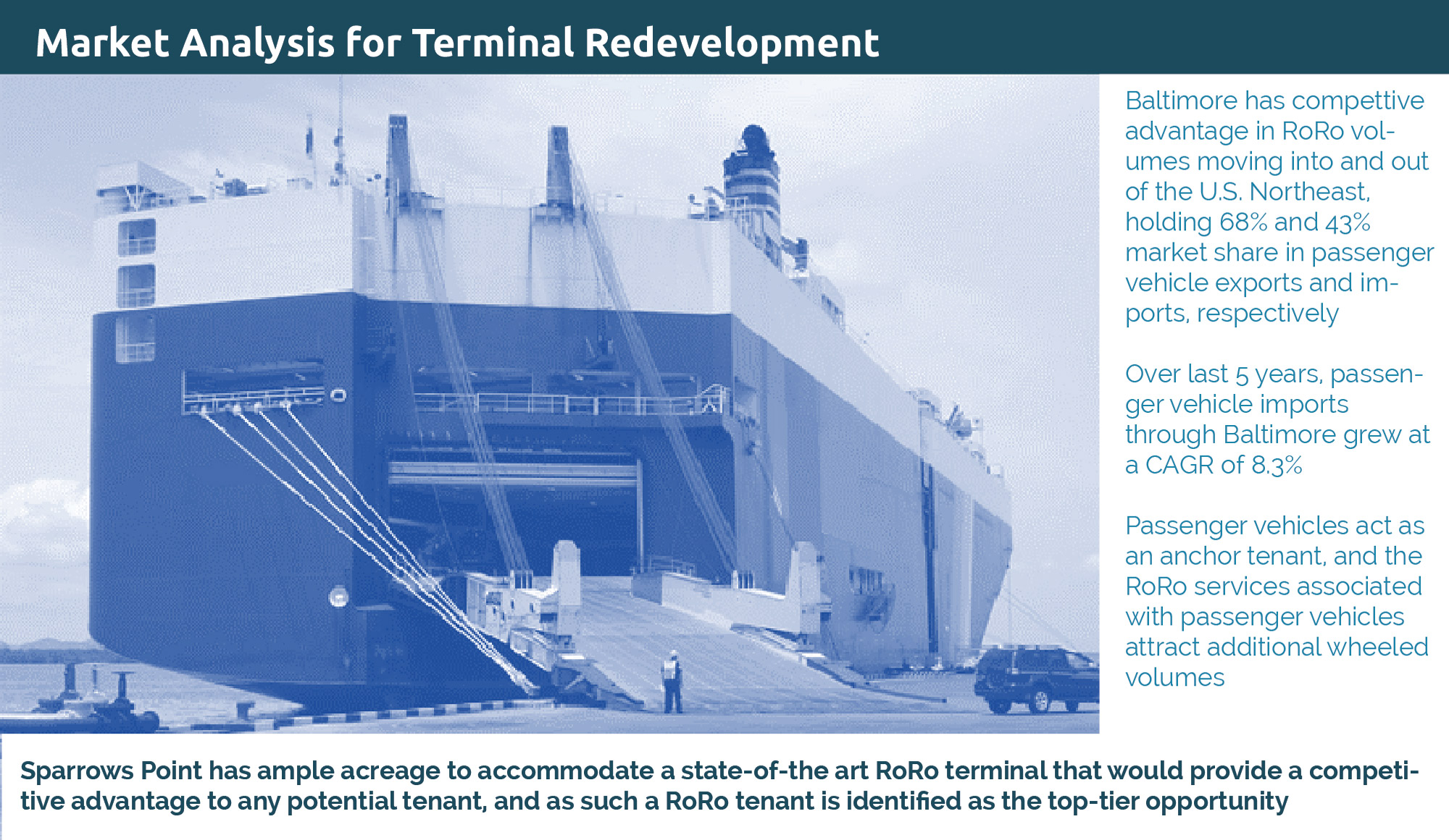

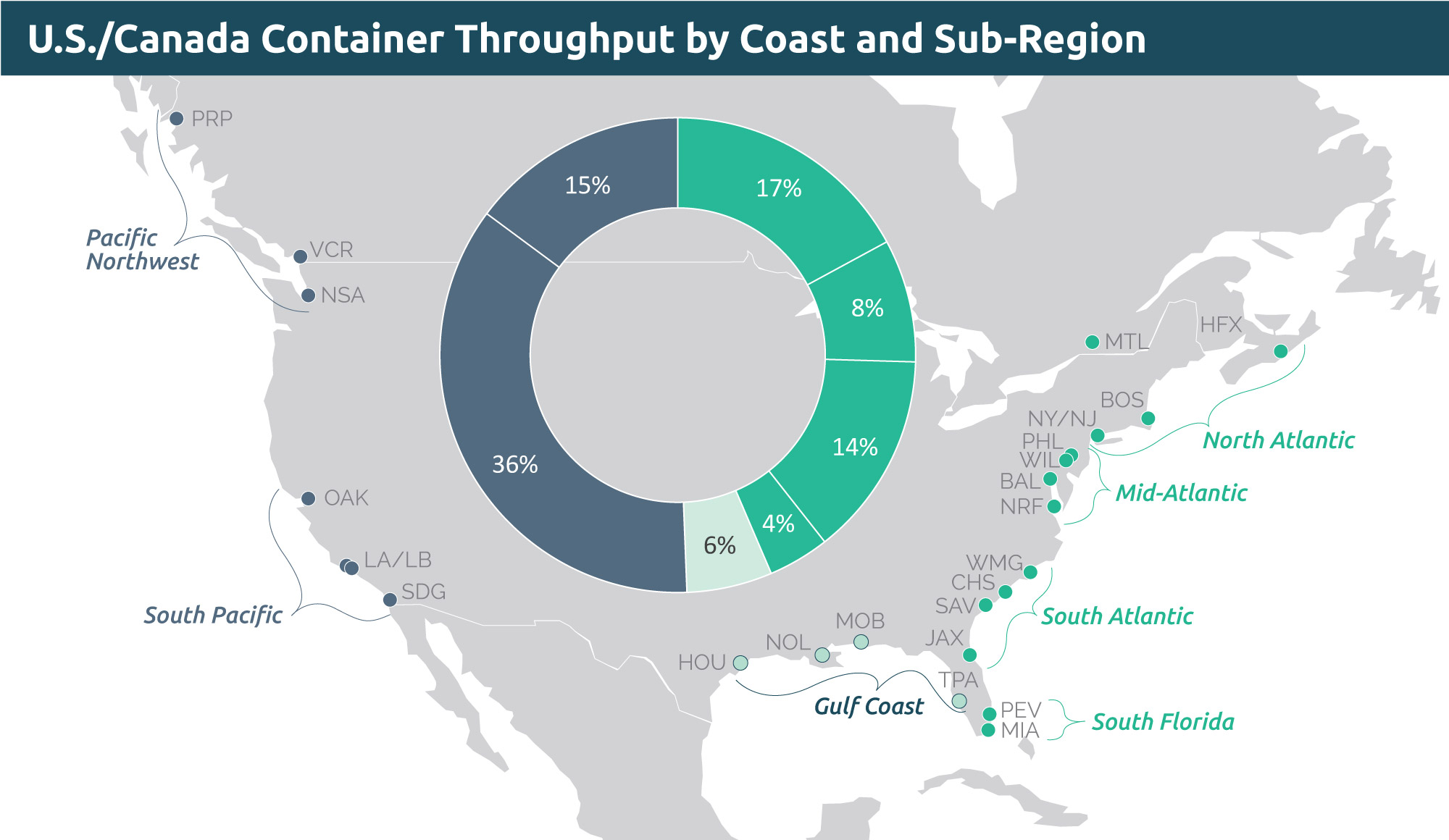

Market Research

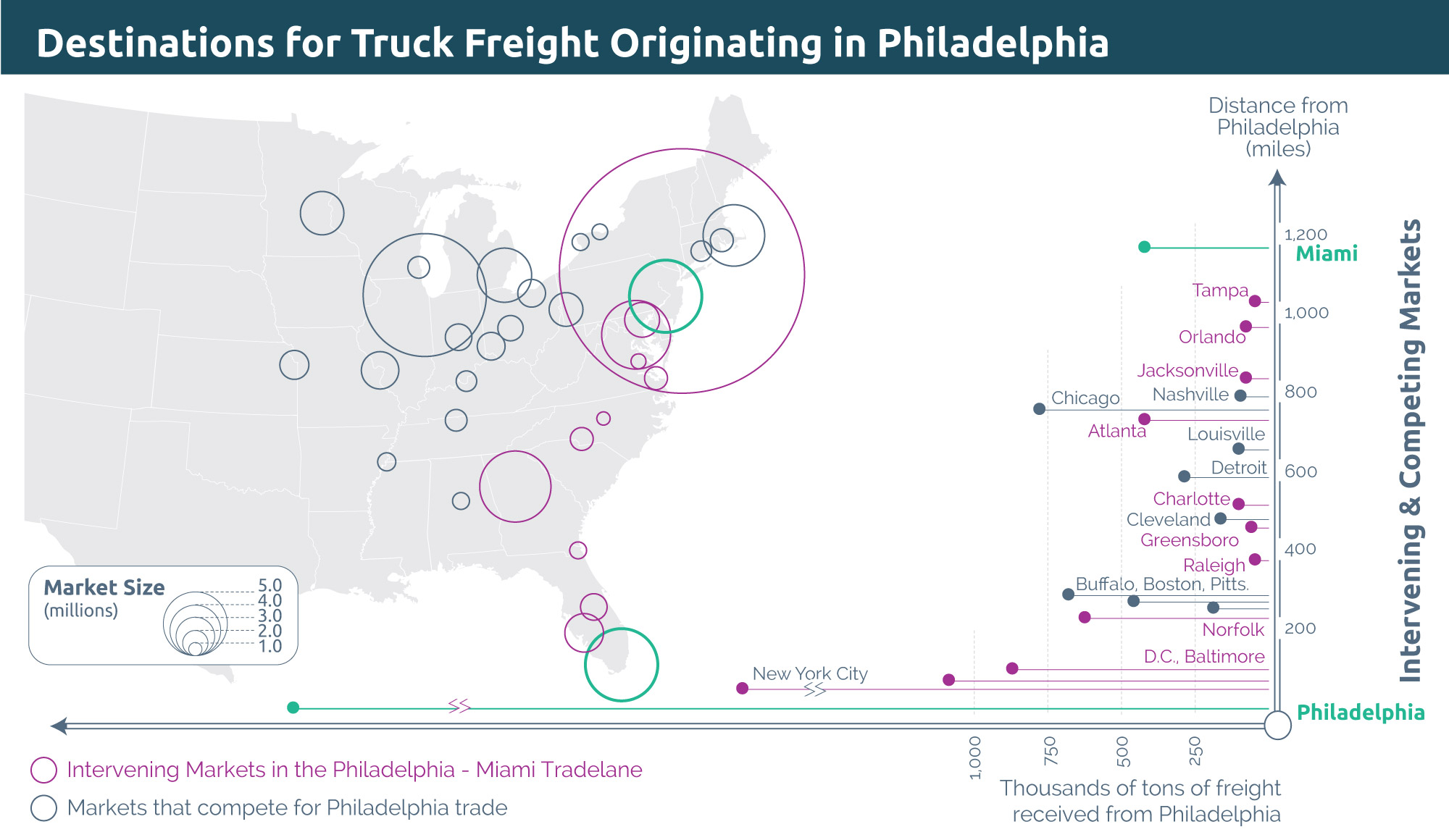

Have you ever felt that you did not have all the information and knowledge needed to make a strategic decision? Perhaps you don’t know where to find key information and/or have the analytical horsepower on staff to find relevant data and transform it into actionable knowledge. Whether it’s a specific traffic flow, a unique commodity, a complex trade, or what the competition is doing, Mercator consultants have deconstructed markets and trades in all corners of the globe and can help you find answers.

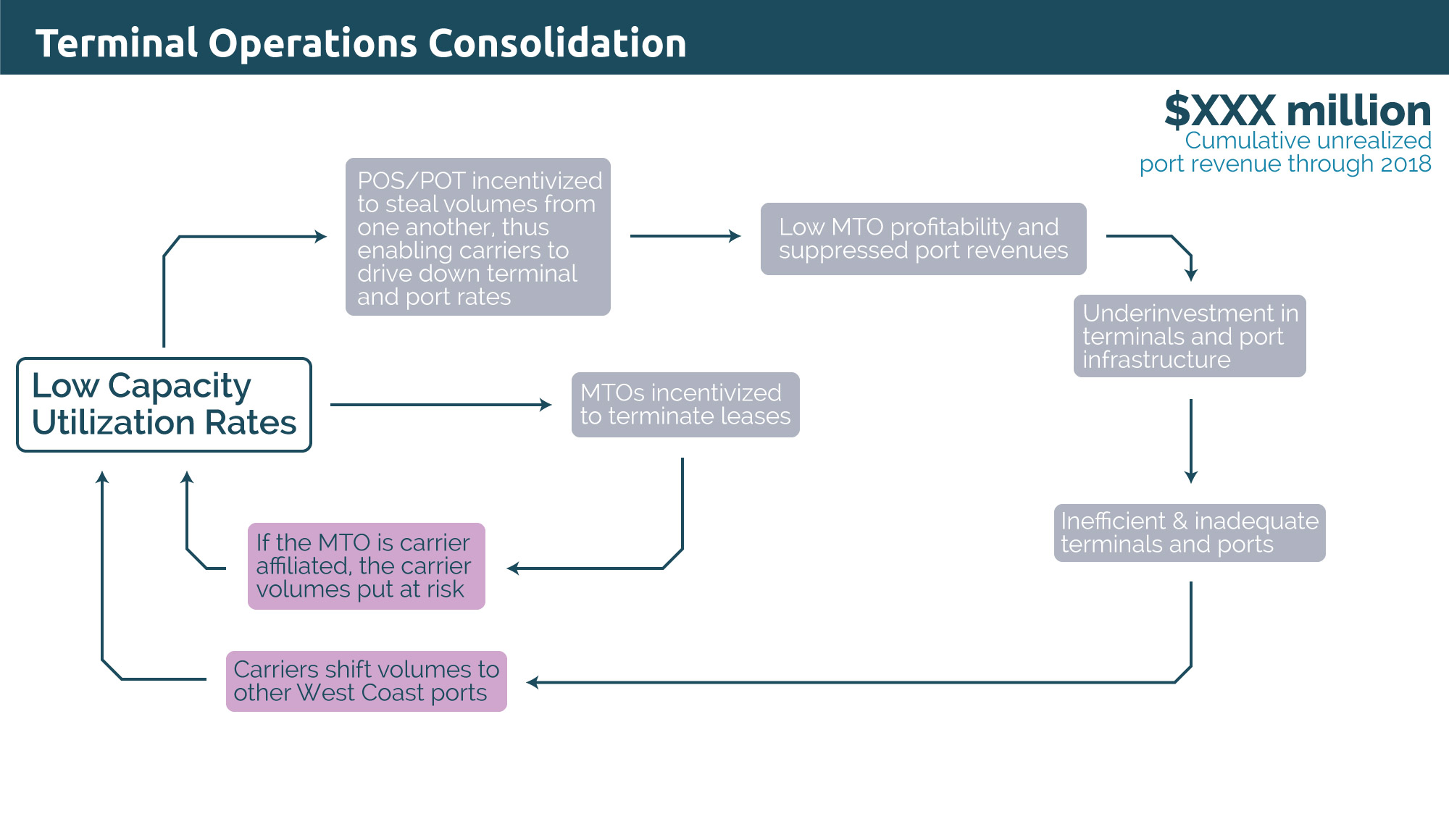

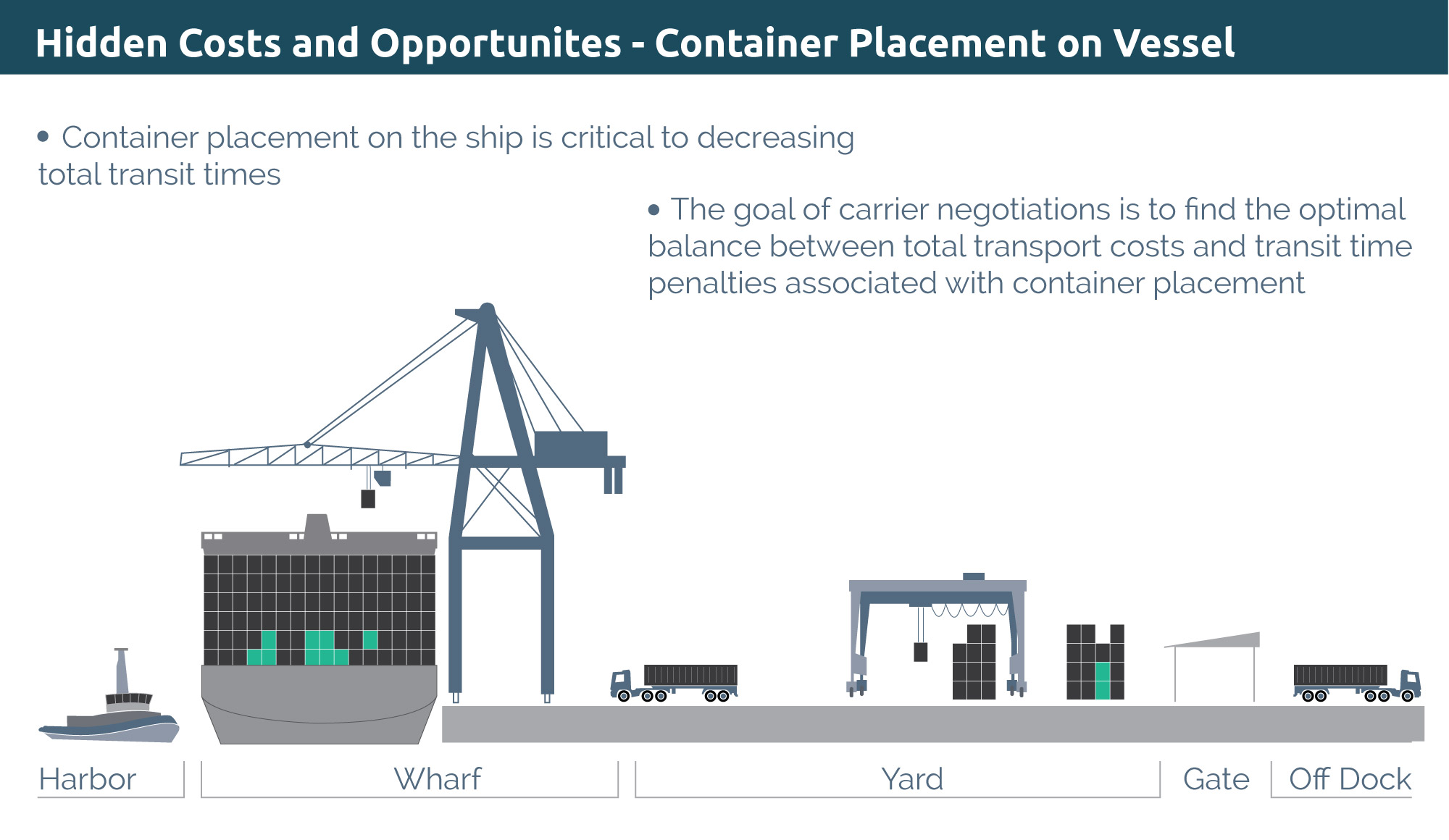

Asset Optimization

Are you unsure if your critical assets are generating maximum value? Mercator consultants have both managed and assessed the operations of businesses in the transportation and infrastructure sectors in markets at home and across the globe. Mercator has the insights you need to benchmark performance, evaluate costs and operational risk, pursue new operational initiatives, restructure processes and systems, while considering the idiosyncratic variables that change from location to location.

Operational Analysis and Modeling

Whether you need to analyze an existing business/operation or a new brownfield or greenfield opportunity, Mercator can put actual numbers to your ideas. Mercator consultants have constructed hundreds of detailed operating models that factor in capital and labor inputs, efficiency factors, labor costs, complex capacity calculations, outsourced services costs, among numerous other variables. Mercator builds models in a manner which makes them intuitive to understand.

Technology and Systems Assessment

With rapid advancement in technology causing major disruptions throughout the transport and logistics chain, staying ahead of the curve is paramount. Mercator consultants have worked directly for premier technology systems providers, and have also deployed new systems in regions all around the world. Mercator can help deconstruct current systems to identify opportunities for improvement, but can also help facilitate migration to new, cutting-edge technologies and systems, including automation.

Marketing and Pricing Strategies

Mercator consultants have negotiated services and prices as both customers and vendors. We combine practical experience with sophisticated, scenario-based analysis to help clients understand the dynamics driving progress in services and prices, whether as providers or consumers. Mercator can help clients understand what customers should be willing to pay under complex circumstances, and helps clients set strategies and navigate through the negotiating process.

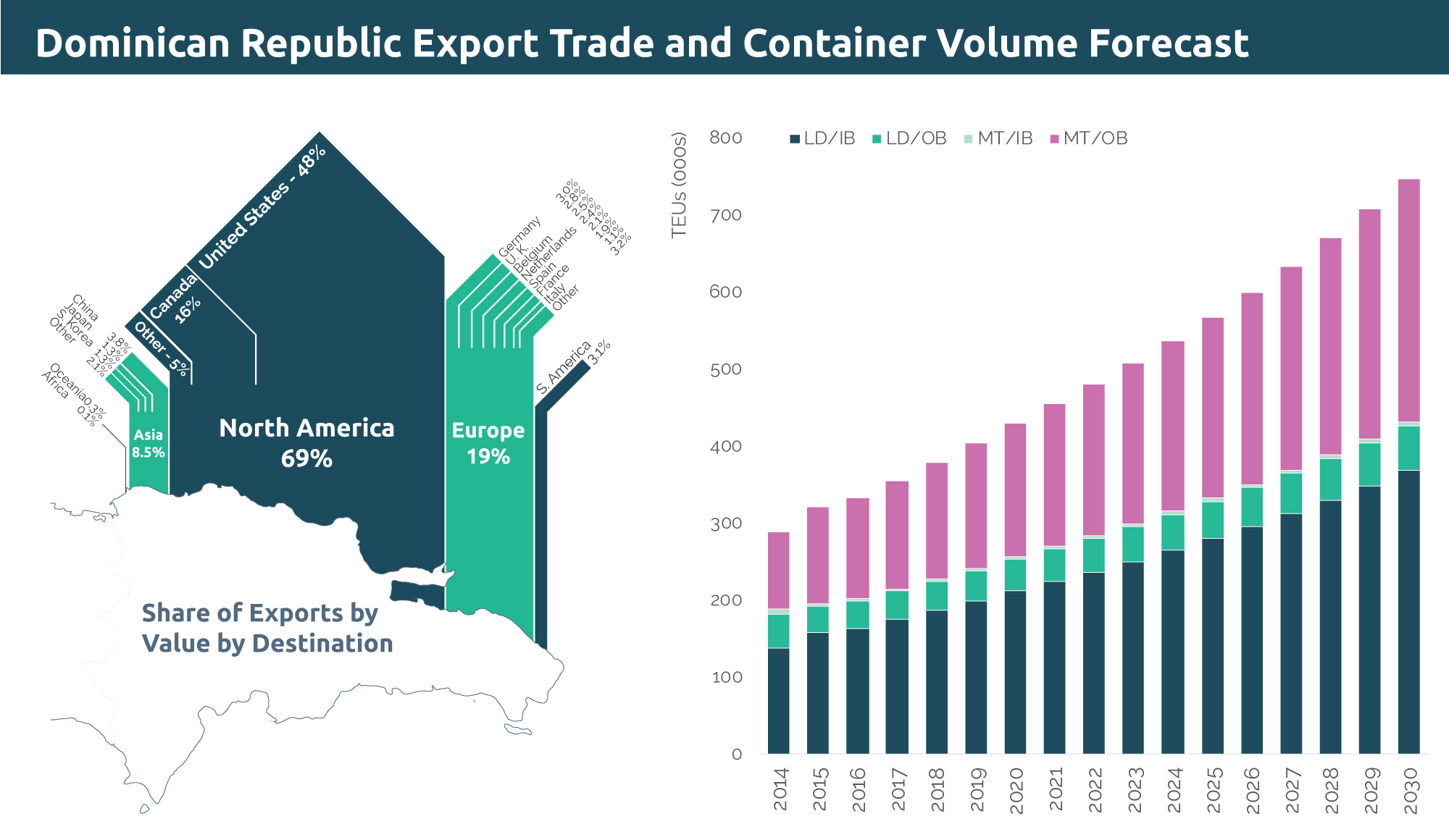

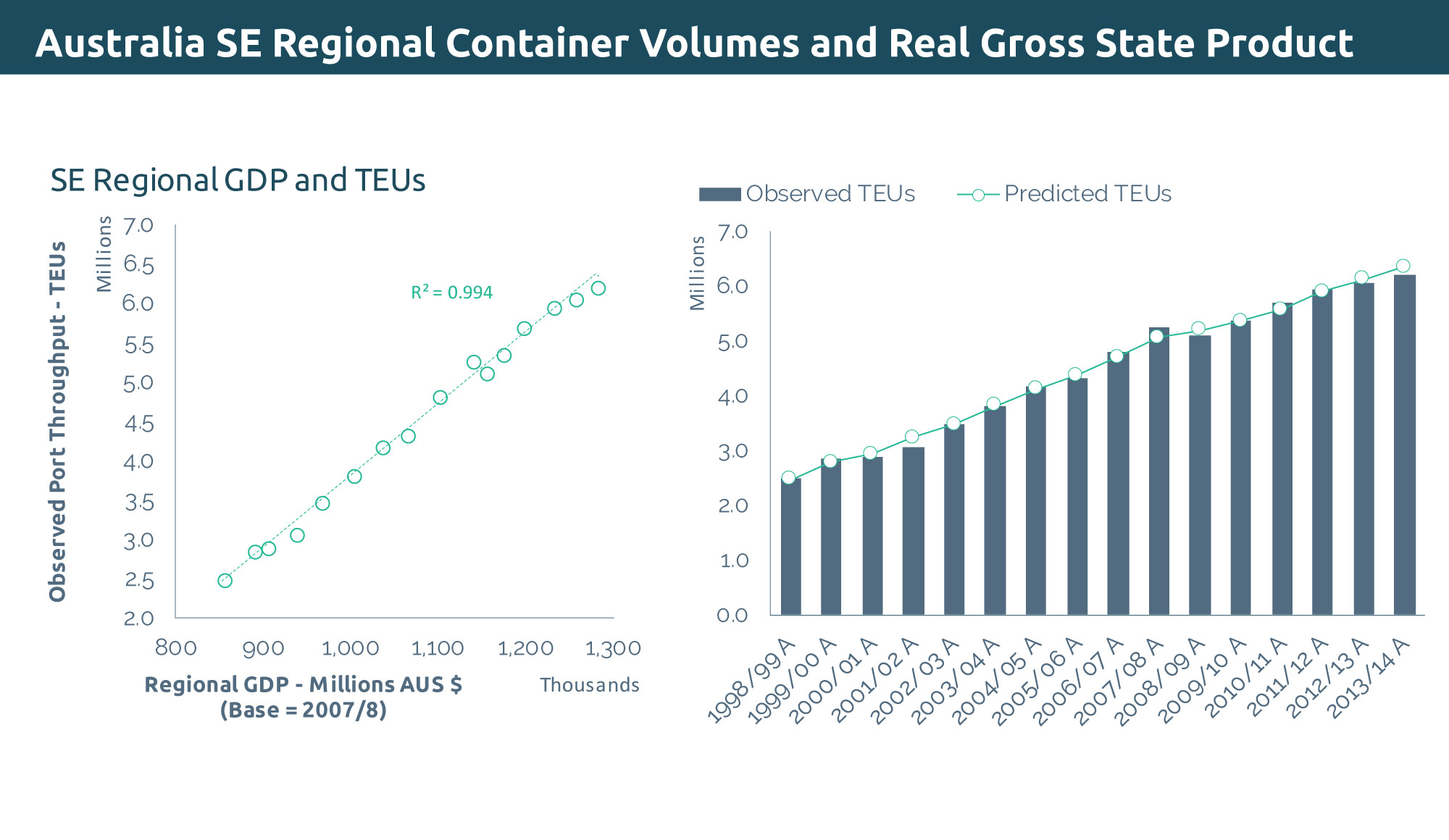

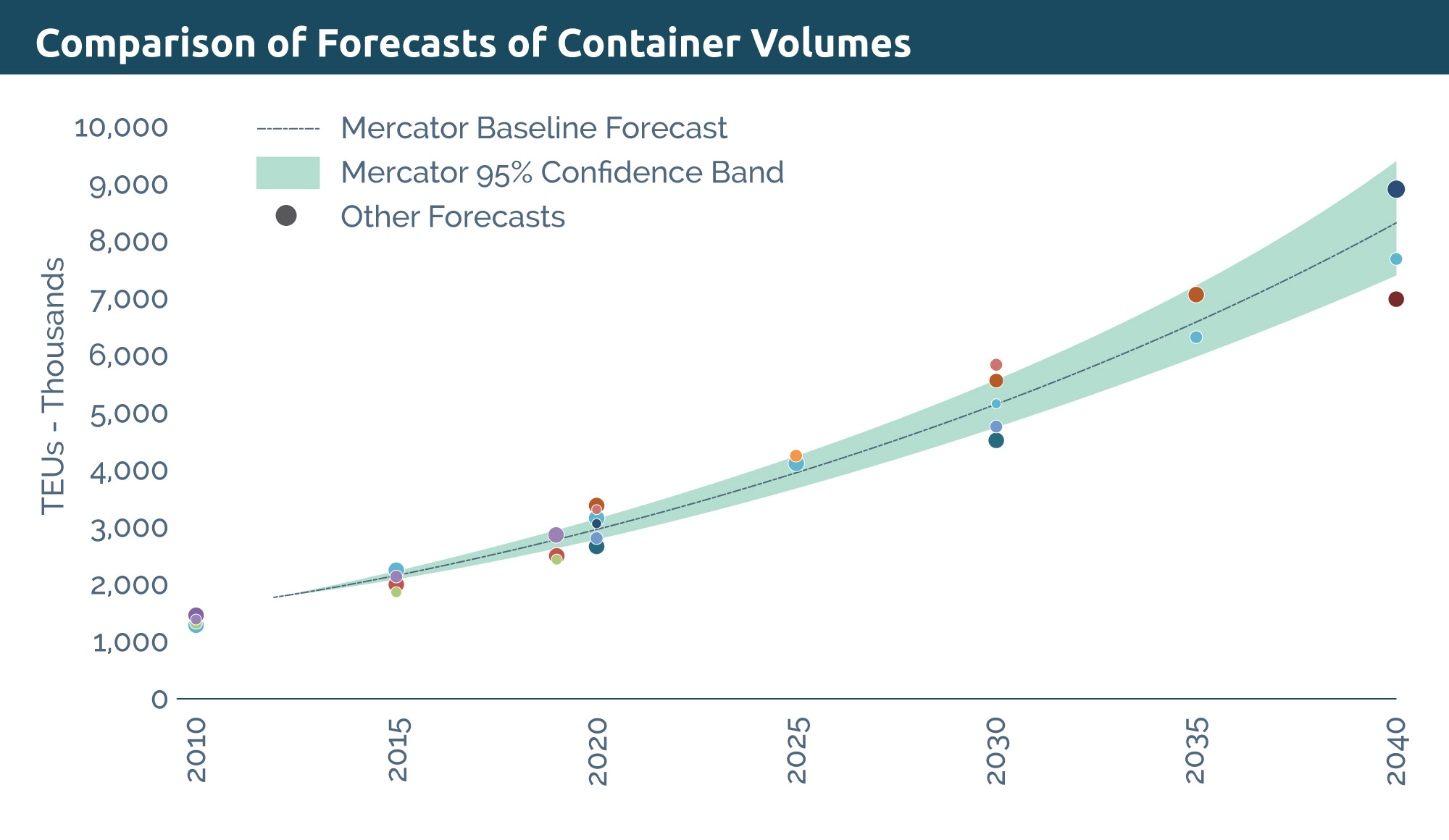

Forecasting

Mercator’s team, as operators, investors, and/or consultants, has developed short and long-term forecasts for businesses around the world. Mercator develops macro and micro-level analysis, uses sophisticated statistical methodologies (including univariate and multivariate regression, Monte Carlo simulation, and others), and combines these with practical, real-world experience to formulate forecasts of volume, rates, operating expenses, and capital expenditures. Mercator then provides insight into risks and opportunities relevant to its forecasts.

Mergers and Acquisitions Support

Mercator consultants have conducted due diligence on hundreds of businesses with operations around the globe for both strategic and financial investors. Mercator has represented both sellers and buyers of businesses in successful transactions. Our diverse experience drives our ability to help clients navigate through complicated M&A situations, from both the buy side and the sell side.

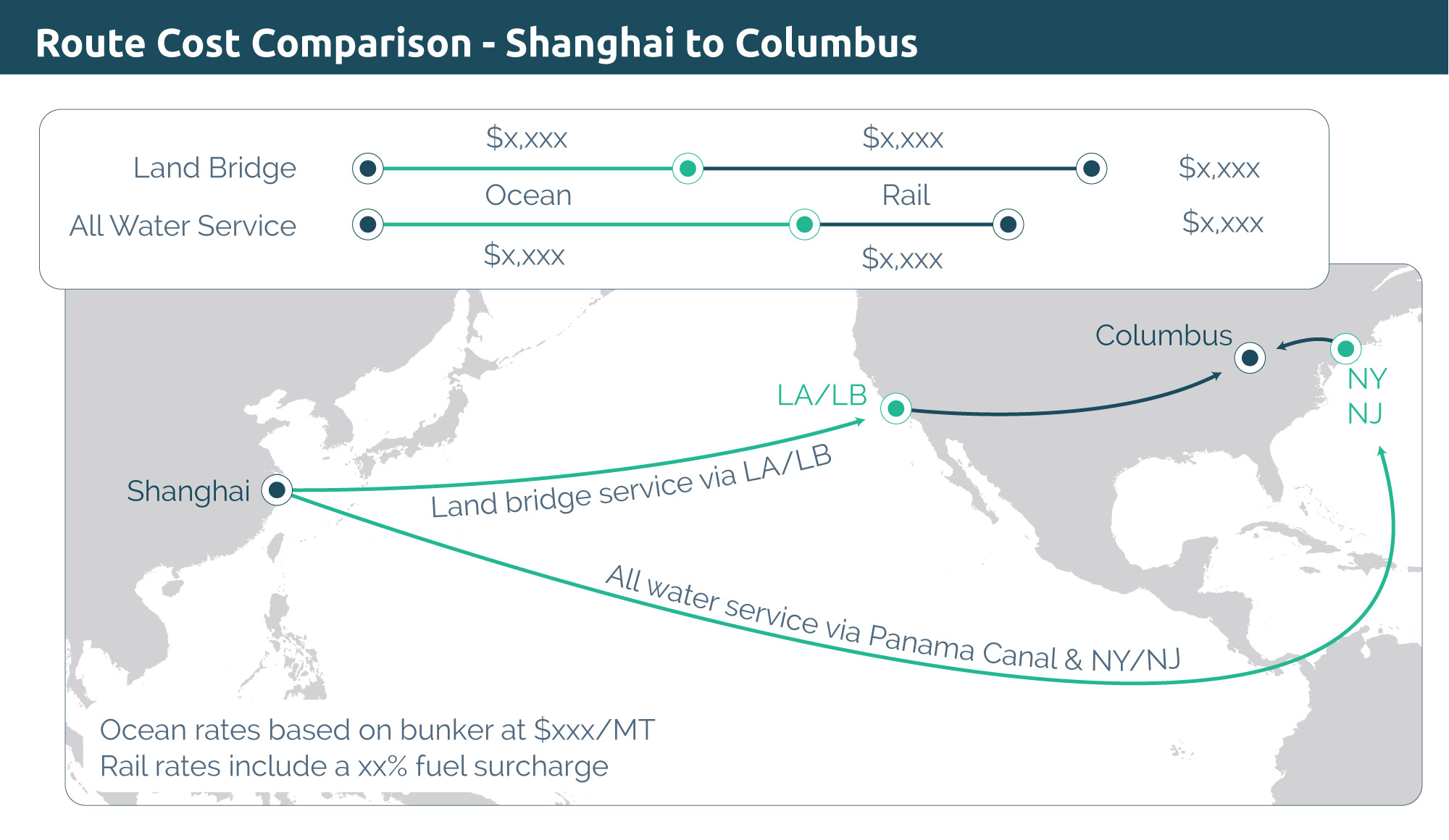

Supply Chain Analysis and Design

Virtually all of Mercator’s engagements encompass some form of supply chain analysis. Whether it’s a question of what is the best route to get cargo from a specific location in Asia to an ultimate destination in Europe, or a scenario-based assessment of routing patterns for agricultural products being exported from the US Midwest to destinations around the world, Mercator has the knowledge and insight to help clients evaluate and reconfigure complex supply chains.

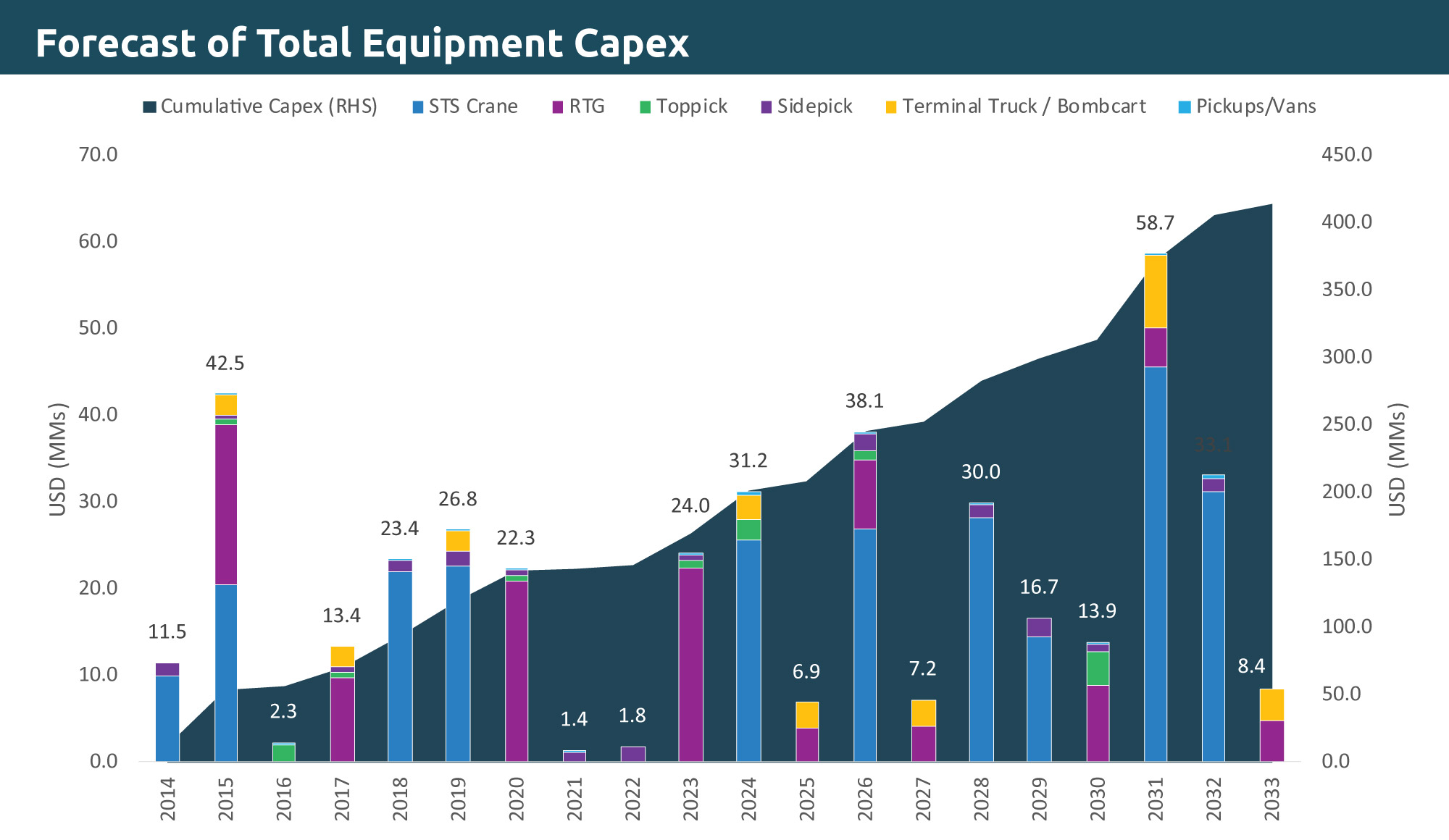

Capital Expenditure Analysis and Planning

Is it time to replace a ship-to-shore crane or perhaps undertake a redevelopment to pursue equipment automation? Is it time to deploy a new ship or build a new warehouse? Mercator has helped both strategic firms and investors understand current and future capex requirements for various types of businesses. Mercator can help clients assess capex needs to increase value, pursue growth opportunities, and raise capital.

Expert Analysis for Dispute Resolution

Mercator’s consultants provide thoughtful and well-informed analysis in support of clients involved in complex arbitration or litigation situations in the transport sector. Mercator consultants have provided expert testimony and provided subject matter analysis and support to lawyers and experts in cases brought before the US District Court, the US Federal Maritime Commission, the London Court of International Arbitration, the Netherlands Arbitration Institute, the International Center for the Settlement of Investment Disputes and the Chamber of Commerce International Court of Arbitration.